XRP Price Prediction: $3 Breakout or $2.80 Breakdown?

#XRP

- Technical Support: $2.80 level critical for maintaining bullish structure

- Institutional Catalysts: ETF approvals and Swell 2025 participation may drive demand

- Regulatory Overhang: SEC case resolution remains key price driver

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Rebound

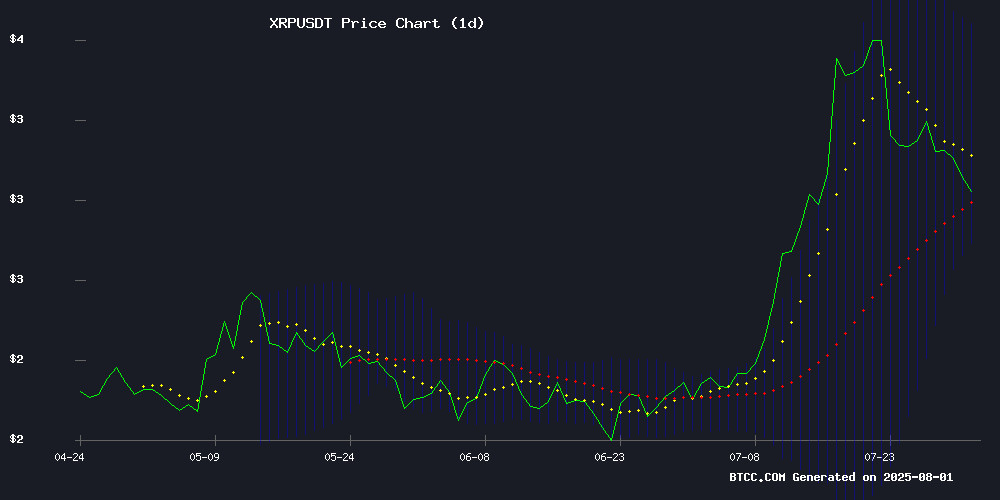

XRP is currently trading at $2.9783, below its 20-day moving average of $3.1925, indicating short-term bearish pressure. However, the MACD shows a bullish crossover with the histogram at +0.2300, suggesting growing momentum. The price is hovering NEAR the lower Bollinger Band at $2.7703, which often acts as support. 'We're seeing classic accumulation signals,' says BTCC analyst Michael. 'If XRP holds above $2.80, we could see a retest of the middle Bollinger Band at $3.19.'

XRP Market Sentiment: Mixed Signals Amid Institutional Interest

News FLOW presents a dichotomy for XRP. While Kraken's delisting and SEC concerns weigh on sentiment, record futures volume and BlackRock's participation in Swell 2025 suggest institutional confidence. 'The $3 level remains psychologically important,' notes BTCC's Michael. 'ETF approvals could be the catalyst for the next leg up, but traders should watch the $2.80 support closely.'

Factors Influencing XRP's Price

XRP Price Prediction: Ripple Tests Key $3 Support Amid Kraken's Mysterious 82M XRP Transfer

XRP hovers near the $2.95 threshold as market participants scrutinize Kraken's transfer of 82 million tokens to an undisclosed wallet. The move, initially interpreted as whale activity, fuels speculation about institutional positioning ahead of a potential breakout.

The digital asset has retreated from July highs between $3.50-$3.60, with the $2.90-$3.00 zone emerging as critical support. A confirmed rebound here could propel XRP toward $3.30-$3.50, with $4.00 remaining within reach should market sentiment improve. "The $XRP bounce will be studied," remarked trader AltcoinGordon, underscoring the technical significance of this level.

Despite price consolidation, on-chain metrics suggest cautious optimism among holders. The transfer coincides with XRP trading at $3.05, down 1.14% over 24 hours according to Brave New Coin's XRP Liquid Index.

XRP Retraces from Highs, $2.80 Support Zone in Focus

XRP has pulled back 7.14% from its recent peak, testing a critical support level at $2.80. This zone represents a confluence of technical factors—Fibonacci retracement, volume-based value area, and high-timeframe structure—making it a pivotal battleground for bulls.

A hold above $2.80 could establish a higher low pattern, maintaining the token's bullish trajectory. The point of control below this level serves as secondary support should the retracement deepen. Market structure remains decisively upward-biased despite the current correction.

The pullback follows a sharp rally that reclaimed XRP's point of control, a key volume benchmark. TradingView charts show the token now navigating what appears to be a healthy consolidation after its recent expansion phase.

XRP to Power Japan’s Tokenized Real Estate Revolution

Japan's financial landscape is undergoing a transformative shift as XRP takes center stage in the country's blockchain evolution. Mitsubishi UFJ Financial Group (MUFG), Japan's largest bank, is spearheading the tokenization of real estate on the XRP Ledger (XRPL), signaling a major leap toward a digital economy. This move underscores Japan's growing reliance on blockchain infrastructure, with XRP emerging as a critical component in real-world asset (RWA) tokenization.

MUFG's initiative aims to convert physical property into digital tokens, enabling seamless trading and investment opportunities for both institutional and retail players. The XRP Ledger's technical capabilities are being leveraged to facilitate efficient settlement and transaction layers, marking one of the most tangible applications of cryptocurrency in traditional finance.

XRP Futures Hit Record Volume as CME Sees Surge in Demand

XRP futures trading on the Chicago Mercantile Exchange (CME) has reached unprecedented levels, signaling growing institutional appetite for regulated crypto products. Record-breaking volume and open interest in July position XRP as a key digital asset beyond Bitcoin and Ethereum in professional portfolios.

CME Group reported historic activity in XRP derivatives, with micro contracts driving momentum. On July 18, 14,612 contracts traded at $126 million notional value, followed by an open interest peak of 4,812 contracts ($43 million) on July 22. The rally culminated on July 24 with 4,766 contracts representing $788 million in notional value.

This surge reflects institutional demand for structured exposure to alternative assets through regulated venues. CME's price transparency and risk management tools align with professional investors' requirements as crypto derivatives gain mainstream traction.

Ripple CTO Clarifies Kraken's XRP Delisting Was Driven by Legal Concerns, Not Personal Bias

David Schwartz, Ripple's Chief Technology Officer, has intervened in speculation surrounding Kraken co-founder Jesse Powell's stance on XRP. Contrary to claims that Powell harbored animosity toward the digital asset, Schwartz asserts the delisting decision stemmed from regulatory uncertainty rather than personal sentiment.

The discussion originated from a casual Twitter poll about Ripple's potential IPO before veering into allegations about Powell's purported dislike of XRP. Schwartz countered these claims, emphasizing that crypto industry participants routinely navigate complex legal landscapes that inform their business decisions.

Kraken's historical position on XRP reflects broader industry challenges as exchanges balance innovation with compliance. Powell has consistently cited regulatory ambiguity as the primary factor in exchange policy decisions, a stance Schwartz's comments now corroborate.

XRP Supporters Urge SEC to Expedite Ripple Case Resolution Amid 'Project Crypto' Rollout

The SEC's newly announced 'Project Crypto' initiative, aimed at modernizing securities regulations for digital asset trading, has intensified calls from XRP proponents to resolve the protracted legal battle with Ripple. Chair Paul Atkins' July 31 unveiling of the framework—designed to clarify crypto market rules—coincides with a critical August 2025 deadline for the agency's status report on the case.

Ripple's recent $125 million penalty payment and dropped cross-appeal in June shifted momentum toward settlement. Industry observers now await an SEC commissioner vote that could formalize Judge Torres' landmark ruling: XRP transactions on public exchanges do not constitute securities offerings. The outcome may test the SEC's commitment to fostering innovation through Project Crypto while addressing legacy enforcement actions.

Full List of XRP ETFs Awaiting SEC Approval: Dates, Filings, and What’s Next

The U.S. Securities and Exchange Commission is reviewing multiple applications for XRP-based exchange-traded funds, with final decisions expected by October 2025. Canada already launched several XRP ETFs in June 2025, while the U.S. lags behind. ProShares Ultra XRP ETF remains the sole approved fund in the U.S., featuring leveraged and inverse strategies.

Grayscale, 21Shares, and Bitwise are among the firms vying for approval. Grayscale's application to convert its XRP Trust to an ETF faces a key deadline on October 18. 21Shares' proposal, filed in November 2024, will reach a verdict by October 19. The SEC's guidelines mandate at least six months of futures trading on platforms like Coinbase's derivatives exchange for eligibility.

Is Ripple Turning Into the MicroStrategy of XRP With Its $122B Holdings?

Ripple's massive XRP holdings, totaling 40.67 billion tokens worth approximately $122 billion, have sparked speculation about a strategic shift. The company could emulate MicroStrategy's Bitcoin treasury model, potentially tightening XRP's circulating supply and driving price appreciation.

AI-driven projections suggest staggering upside scenarios. Capturing 1% of the $150 trillion cross-border payments market could propel XRP's market cap to $1.5 trillion, with prices reaching $25. Displacing traditional nostro accounts could push valuations beyond $45 per token.

The mere locking of Ripple's reserves might double XRP's price to $6 within a decade. These projections highlight the transformative potential of institutional crypto adoption, though market dynamics remain unpredictable.

BlackRock, Nasdaq, Citi Join Ripple Swell 2025 – XRP Price Set for 100% Rally?

Ripple's flagship event, Swell 2025, is set to take place in New York City on November 4–5, marking its first appearance in the financial hub. The conference, backed by heavyweight institutions like BlackRock, Nasdaq, and Citibank, has historically served as a catalyst for significant XRP price movements, with past announcements triggering rallies of up to 50%.

This year's event arrives at a critical juncture for Ripple, following the resolution of its legal battle with the U.S. SEC. The gathering will feature high-profile speakers and is expected to unveil new product demos and policy discussions, potentially fueling another surge in investor interest.

The choice of NYC as the venue underscores Ripple's deepening ties with traditional finance, a trend that could further legitimize XRP in institutional circles. Market watchers are speculating whether this edition could surpass previous years in terms of impact, given the confluence of regulatory clarity and Wall Street participation.

Ripple Lawsuit: Is the SEC Dropping the XRP Case Today?

The legal standoff between Ripple and the U.S. Securities and Exchange Commission (SEC) remains unresolved, despite speculation about a potential dismissal. The Second Circuit Court of Appeals has placed the case in abeyance, awaiting a status update from the SEC by August 15, 2025.

Rumors of an imminent dismissal gained traction after reports surfaced about a closed-door SEC meeting. However, former SEC attorney Marc Fagel tempered expectations, noting that any dismissal would require a formal vote by the agency's commissioners. Until then, the injunction against Ripple stands, and both parties retain their appeals.

XRP Retreats 8% From $3 High Amid Sell Pressure, Shows Signs of Accumulation

XRP faced a sharp 8% decline over 24 hours, retreating from a session peak of $3.17 to $2.94 as sell orders overwhelmed early bullish momentum. The most dramatic drop occurred at midnight UTC on August 1, with a 2.7% hourly plunge accompanied by 259 million XRP changing hands—four times the daily average volume.

Despite the selloff, signs of accumulation emerged during the rebound to $2.98. Declining volume after initial volatility suggests institutional buyers absorbed supply near key support levels. Whale activity presents conflicting signals: on-chain data shows large holders have reduced positions over 90 days, yet exchange balances dropped sharply during the correction—a potential indicator of capital inflows.

BlackRock's Digital Assets Director Maxwell Stein reinforced institutional interest, confirming participation in upcoming industry discussions. The price action underscores XRP's ongoing battle between distribution pressure and strategic accumulation at lower levels.

How High Will XRP Price Go?

Based on current technicals and news catalysts, XRP could see two potential scenarios:

| Scenario | Price Target | Key Levels |

|---|---|---|

| Bullish | $3.61 (Upper Bollinger) | Must hold $2.80 support |

| Bearish | $2.50 | Break below $2.77 lower band |

'The 100% rally potential exists if institutional demand continues,' says Michael, 'but regulatory clarity remains the missing piece.'

1